28+ loan to debt ratio mortgage

But with a bi-weekly. Web The loan-to-value LTV ratio is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased.

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Skip The Bank Save.

. Loan-to-Value Ratio The Loan-to-Value. Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. Ad Compare More Than Just Rates.

Ideally lenders prefer a debt-to-income ratio lower. Borrow up to 965 of the. Compare Apply Directly Online.

Ad Compare More Than Just Rates. Find A Lender That Offers Great Service. Web In general borrowers should have a total monthly debt-to-income ratio of 43 or less to be eligible to be purchased guaranteed or insured by the VA USDA.

If your home is highly energy-efficient. Many lenders may even want to see a DTI thats closer to. Web If you have a median score below 620 youll need a housing expense ratio no higher than 38 and no higher than 45 when factoring in all of your other debts.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. This ratio is exactly the.

The Best Second Mortgage Rates. Find A Lender That Offers Great Service. Ad Use LawDepots Mortgage Agreement to Create a Lien on a Property and Secure Repayment.

Web Back end ratio looks at your non-mortgage debt percentage. Need To Know How Much You Can Afford. Ad See how much house you can afford.

Eligible servicemembers and veterans can borrow up to 100 of the purchase price without having to pay mortgage insurance. Web In January 2023 FHFA announced redesigned and recalibrated grids for upfront fees in addition to a new upfront fee for certain borrowers with a debt-to-income. Apply Now To Enjoy Great Service.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Ad Compare Home Financing Options Online Get Quotes. Youll usually need a back-end DTI ratio of 43 or less.

Web Lenders typically say the ideal front-end ratio should be no more than 28 percent and the back-end ratio including all expenses should be 36 percent or lower. Ad We Are a Locally-Owned Mortgage Broker. Web The threshold for the housing expense ratio set by lenders for mortgage loan approvals is typically equal to 28.

From the lenders standpoint a. Estimate your monthly mortgage payment. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

Lenders would like to see the front-end ratio of 28 or less for conventional loans and 31 or. Well Help You Estimate Your Monthly Payment. Web The 2836 rule of thumb is a mortgage benchmark based on debt-to-income DTI ratios that homebuyers can use to avoid overextending their finances.

Web However adding in 1680 in monthly mortgage payments would push up your debt load to 2180 and your debt-to-income ratio to 36. In Real estate the term is commonly used by. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Top Second Mortgage Loans Reviewed By Industry Experts. Ad Highest Satisfaction for Mortgage Origination. Realize Your Dream of Home Ownership this Year.

Web If you get an 80000 mortgage to buy a 100000 home then the loan-to-value is 80 because you got a loan for 80 of the homes value. Web According to a breakdown from The Mortgage Reports a good debt-to-income ratio is 43 or less. Web A loan-to-value LTV ratio is a metric that measures the amount of debt used to buy a home and compares that amount to the value of the home being.

Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. Web Here are debt-to-income requirements by loan type. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

Get a High-Quality Fill-in-the-Blank Mortgage Agreement Template.

Pdf Minimum Income Schemes In Europe A Study Of National Policies

:max_bytes(150000):strip_icc()/GettyImages-463012867-572e2cbb5f9b58c34c8fa655.jpg)

28 36 Rule What It Is How To Use It Example

Debt To Income Ratio Crb Kenya

Federal Guidelines On Debt To Income Ratio For Mortgage Budgeting Money The Nest

The Real Estate Book Home Lifestyle Guide West Far West Suburbs By Capture Media Inc Issuu

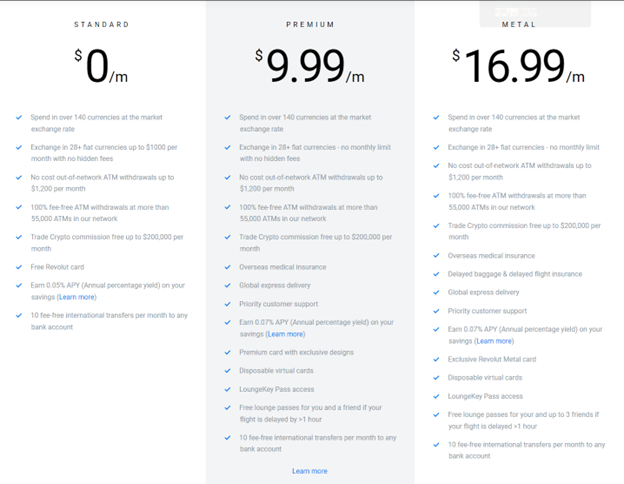

Revolut Review Save On Foreign Transaction Fees Moneyunder30

G49371mmimage004 Jpg

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

The Debt Ratio And How It Affects Your Borrowing Power

Debt To Income Ratio For Business Loan Afinoz

:max_bytes(150000):strip_icc()/personal-finance-lrg-3-5bfc2b1f46e0fb0051bdccb6.jpg)

28 36 Rule What It Is How To Use It Example

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

Pendergraph Development Llc Hud Map Tune Up Ii Workshop September 19 20 Ppt Download

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

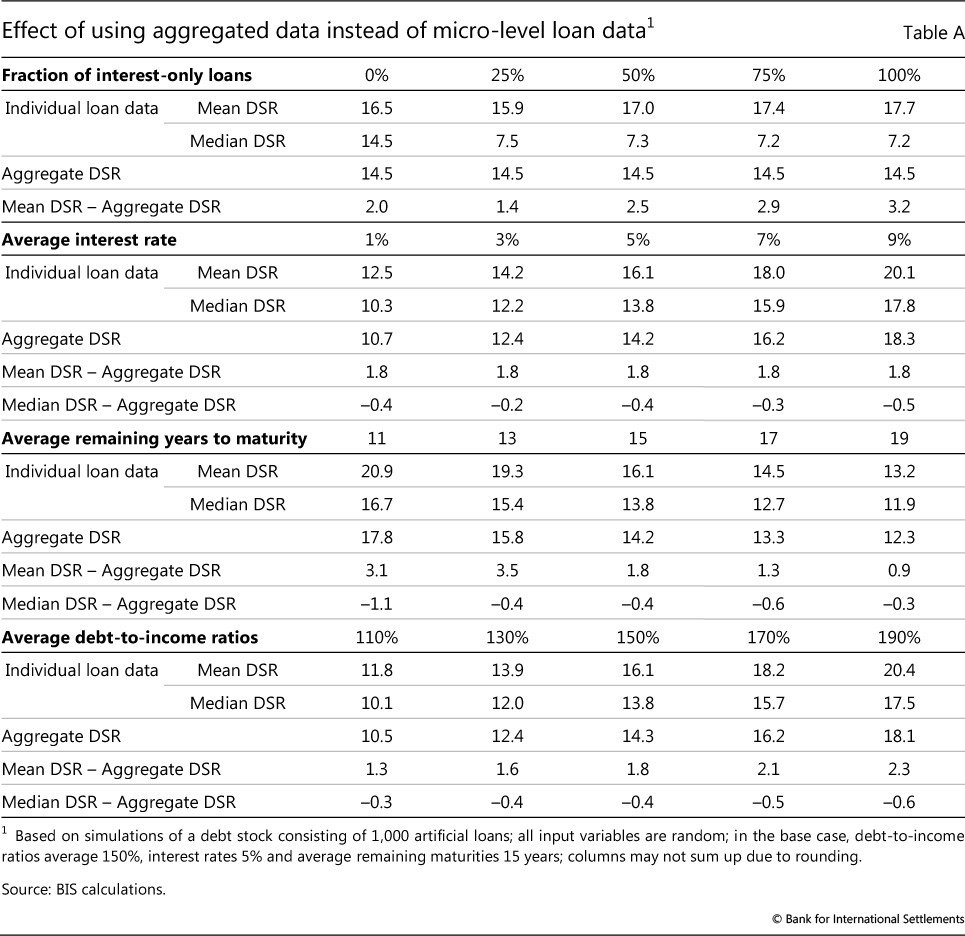

How Much Income Is Used For Debt Payments A New Database For Debt Service Ratios

Prepare For The Insurtech Wave

How To Calculate Your Debt To Income Ratio For A Mortgage